Fuel: The New Luxury

The retail petrol and diesel prices of automobiles in India have reached record highs across the country. The utmost surprise to the fact is that even though the crude oil prices have been economical in the international markets, still the retail prices are out and out incompatible. The inevitable upsurge in the fuel prices have ended up landing at three figures mark recently. Still the situation does not seem to be soothing in the days to come.

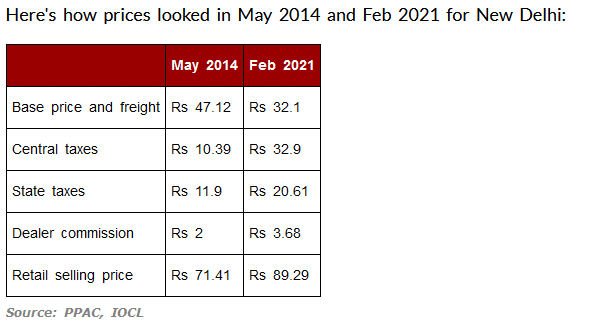

India is substantially dependent on imports as far as petroleum is concerned. It imports nearly 84% of its domestic demand of crude oil, which is why the price fluctuates in tandem with the global demand. In view of the economists, the root cause is reduction in the supply of oil barrels by the OPEC. During the course of pandemic, the demand for the same were biting the dust and resultantly the prices fainted to negative which escorted heavy losses to the OPEC countries. So, the need of the hour was to cover the dig. Consequently, they brought a significant decline in the supply of crude oil by reducing its unearthing from petroleum wells by not less than 10 million barrels a day, hoping to boost prices. Therefore, the decrease in supply led to the rise in prices when demand was back in the game. Presently, it costs nearly $40-50 per barrel. The Finance Minister of India has proclaimed the scenario to get better in the long run. Another major reason for the hike is attributed to an increase in tax determination by the Central/State governments. Fairly, tax compounds to 69% of the total price of petrol that we as consumers pay. For example, the excise duty on petrol has increased to Rs. 32.9 from Rs.19.89 at the beginning of the year 2021.

So, from the given table above you can apparently end up seeing that the lion’s share in the ultimate price is consumed by the taxes imposed by the government authorities. Currently, the petrol prices in Delhi, Mumbai, Kolkata, and Chennai are Rs. 94.49, Rs.100.7, Rs. 94.5 and Rs. 95.99 respectively as on June 2, 2021. In order to fill its pocket, the government seems to leave behind the concern of the ranks and file. It is the petroleum companies which hold a vital position for the government’s revenue generating source. This gives a clear view that the government is trying to make up for its losses suffered during the pandemic. Besides that, it cannot be denied that the government is trying to give an edge to the initiatives for electric and CNG run automobiles and vehicles. So, the consumer will drive their way towards them. The only concern is that a catalyst is required to trigger their dominance and concrete its presence in the market.

We have seen in the past that a hike in fuel prices influences other commodities as well. It does not get limited to the direct customers of prices but also affects other means. Since it causes a rise in transportation cost, production & manufacturing cost every single aspect of daily necessities is affected too. Given that almost every industry is driven by energy, the cost of which ultimately boils down to the consumer, this will ultimately have a negative impact on the scale of production which may prove counterproductive if the prices increase further leading to a collapse in demand. Usually when fuel prices go up, we see an inflationary impact and depreciating exchange rate. This tends to impact anyone owning a business which involves foreign currency. An industry insider has noted: “Diesel has a secondary effect. Since all the trucks run on diesel, it will increase the freight cost, which in turn finds its way to increasing the price of food grains, goods and other products.”

Most public transport rents have gone up by 10-12%. Logistics firms are incurring Rs. 1/ Kg extra to transport food & vegetables. Online food delivery platforms are working on higher fees for their staff now gearing up to charge a higher price for the same. Jet fuel prices, which account for 40% of airline costs, have surged about 50% per KL in 7 months to January. It cannot be denied that the hike in price has aided, as far as government revenue is concerned. It’s high time that both the central and state governments should abstain from making prolonged money. Instead of taking tax as bone of contention between governments, the approach should be positive. The need of the hour is materialistic decline in the rate of taxes imposed. Simultaneously, on the other side of the page, consumers need to indulge into practicing more of the substitutes and promote EVs.

By Adarsh Agarwal

Also Read:

PLAYING THE MARKET: STOCKS OR SLOTS-Deciphering the fine line

Playing the market: Stocks or Slots?Deciphering the Fine line The world of finance, the stock …

Social Echoes: Amplifying Sales through Digital Word-of-Mouth

Social Echoes: Amplifying Sales through Digital Word-of-Mouth It is a truth universally acknowledged that E-Commerce …

Unlocking the Potential: A Comprehensive Analysis of the IMEEEC

Unlocking the Potential: A Comprehensive Analysis of the India-Middle East-Europe Economic Corridor (IMEEEC) Abstract The …