Contemporary Inflation Dynamics :

Commodity Viewpoint

Introduction

The mankind, ever so progressing, witnessed its largest halt when it was struck by the once-in-a-century pandemic last year. The ubiquitous pandemic, acting as a watershed in human history, had affected the global economy and galvanized various policy makers into changing their policy discourse. In theory, an economy responds to recession, as stimulated by the pandemic, by following an expansionary monetary policy. It includes increasing the money supply in the hands of the public by increasing the quantity of loans and reducing interest rates.

Now, a small percentage of inflation, around 2% is unavoidable and even advisable since it stimulates consumer expenditure in a positive manner. But the economy tends to be threatened once the inflation rate goes higher than 2%. The world witnessed the same when the prices of energy, metals, food and other raw materials used for manufacturing, everything from semiconductor chips to high rise buildings, started increasing and nearly doubled in the past year.

A stagnant increase of 5% in the world household incomes and 4% in per capita terms has been resulting in an increase in global demand for food. This has led to an increase in food prices around the globe in recent years. Furthermore, unfavourable weather leading to crop failure in the major food growing nations such as Brazil and France have engendered the surge in food prices.

The rising demand for meat as a share of the diet has intensified the pressure on oil-seed and grain prices because of an increase in prices of animal fodder used in rearing poultry. The costs of corn and soybean meal used to feed livestock have seen a sharp rise in prices in the past year.

What’s causing the turmoil?

Major rice exporters such as India and Vietnam have cut off their rice exports to other countries due to increasing food prices in the domestic country. Therefore, the effects on the rice importing countries have been massive. Surging food prices have forced several poor and developing countries and food importing regions into poverty and hunger.

The oil prices are witnessing a strong surge since the beginning of the year after the oil extraction countries have cut down on their production. The increased demand for energy and oil in order to bring the economy back on track after the pandemic has also contributed towards rising oil prices.

China, the largest developing country, has seen the maximum economic growth in the past decade, being almost double of the world’s average. It is playing a major role in increasing commodity prices as the government constantly makes efforts to reduce its production of high demand commodities like metal such as steel and aluminium. Economies recovering back from the pandemic blow are focusing on building infrastructure which has led to an increase in metal demand worldwide.

At the same time, China has been facing power outages in order to save energy. The drastic increase in coal prices has invoked the country to force factories to shut down that has led to halts in the production of commodities, thus affecting the global supply chain. All these reasons have led to a cascading effect in the world economy leading to inflation.

History repeating itself?

Could the surging commodity prices in the past one year signal a return of the inflation seen in the 1970s? This question has invoked various discussions among people, more so since the commodity prices are expected to go even higher. The world had seen the largest inflation in the 1970s. The economies were driven by war at that time. The governments of several countries had increased their expenditures in order to recover from war times, leading to inflation. In addition to this, the rising tension in the Middle East had led to an oil embargo resulting in an increase in crude oil prices across the world.

Something similar is happening in the present times. The economy reopening after the pandemic has stimulated the consumer and government expenditure leading to rising prices in the market. The pandemic created a turmoil in the world economy and acted as a stimulator for rising prices. Although there are a few major differences between both eras that signals towards the inflation of not being as intense as it was in the 1970s. But a closer look at the factors affecting the United States, which was one of the most affected countries during great inflation in the 1970s will help us understand this better.

Difference in the structure of labour market

Back in the 1970s, workers had formed unions to keep track with inflation. The workers had high bargaining power. Currently, the unionism is comparatively low due to their disorganisation and hence it has reduced their bargaining power.

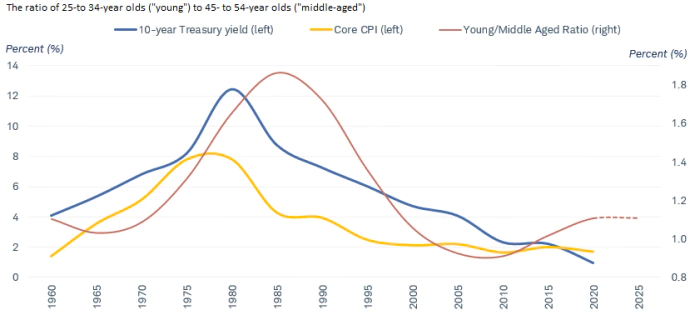

Demographic waves appear to have created in the recent years

Impact of Commodity Rally

As every raw material becomes more expensive day by day, the rally is working in favour of some countries and against some countries around the world which can create huge gaps between the countries from a financial point of view. Moreover, the impact of commodity rally is dependent on the trade status of the country, as in whether the country is an exporter or an importer of a particular good.

The countries who depend heavily on exporting raw materials hugely benefit from the rising prices of commodities and their increasing demand, especially after going through the difficult pandemic period. That’s one of the main reasons why countries like Australia, trading in iron ore, Chile, trading in copper and Indonesia, trading in palm oil are generating exorbitantly high amounts of revenue through exporting.

On the other hand, the countries who heavily depend on imports, find that they’re able to purchase less material than they were used to, owing to a surge in commodity prices.As a result they are not able to meet their domestic demands and hence it is leading to shortages within their own borders. A positive is that these nations can try and develop their domestic industries to manage this shortage but they are either short on human resources or the financial means.

The prices of metals such as steel, aluminium, copper, palladium, and rhodium have surged recently, forcing numerous supporting businesses, such as automobiles, to raise vehicle prices across sectors. The counter effect feared because of this is the increase in prices of real estate projects worrying real estate developers across the world. Oil prices are projected to revert to their prior levels once global growth slows down, depending on how much this will affect the world’s fastest-growing economies. It’s difficult to predict how long the effects of inflation caused by surging commodity prices will last, but the inflation is expected to be transitory.

Conclusion

There’s no one solution for all countries, given the diversity in their economies. The governments should start by fixing the sources of the ongoing ripple effect causing inflation worldwide. The poor regions, such as Africa, which were worst hit by the pandemic, should be given enough funding to sail through these tough times which can be done by raising funding through various international agencies. The world should focus on long-term research into agricultural production in order to prepare themselves for any situation which could lead to a surge in food prices. Inflationary pressures, especially those fueled by an abrupt increase in commodity prices, exacerbates poverty, increases hunger and limits access to key services like education and health care. Further strengthening and coverage of social protection services can play a vital role in mitigating the worst effects not only in the present but also in the future.

Delays in responding to rising inflation can undermine monetary policy credibility, especially if inflation expectations are poorly grounded, as they are in many emerging economies. As a result, more active monetary policy actions may be required in the long run to bring inflation back to target, at a higher cost in terms of output than a timely monetary policy reaction would have entailed. The economies around the world may be in for an old-fashioned boom and bust cycle of expansion and recession, and could expect more difficult times ahead.

By Anjali Tanwar

Also Read:

PLAYING THE MARKET: STOCKS OR SLOTS-Deciphering the fine line

Playing the market: Stocks or Slots?Deciphering the Fine line The world of finance, the stock …

Social Echoes: Amplifying Sales through Digital Word-of-Mouth

Social Echoes: Amplifying Sales through Digital Word-of-Mouth It is a truth universally acknowledged that E-Commerce …

Unlocking the Potential: A Comprehensive Analysis of the IMEEEC

Unlocking the Potential: A Comprehensive Analysis of the India-Middle East-Europe Economic Corridor (IMEEEC) Abstract The …