Adani: The man who can't think small

A person who has dived into all the sectors of the economy be it construction, ports, FMCG, aviation, or telecom, and achieved a huge milestone of a personal net worth of nearly $150 billion making him India’s richest and the world’s third richest man “Gautam Shantilal Adani”. He is an Indian industrialist who is the chairman and founder of Adani Group which is a multinational conglomerate.

Background

At the age of 16 in 1978, Mr. Adani moved to Mumbai to work as a diamond sorter working for The Mahendra Brothers. Later, he himself entered into a partnership with his cousins Girish and Prakash to start his entrepreneurial journey involving the trading of diamonds. This business of diamonds honed various skills in Adani such as nurturing his instincts in finance and earning knowledge about the diamond market which helped him to succeed in the diamond business venture. The diamond venture did not do well and the deal got squared off which Adani get a brush about the unexpected consequences of business and trading.

The setback didn’t hold him back and he moved back to his hometown, Ahmedabad in 1981 where he joined his elder brother in his venture PVC imports where he got a taste of global trading. After working there for 7 years, he established his own enterprise “Adani Exports” under Adani Enterprises which dealt with agricultural and power commodities. He listed this business on BSE in 1988 as his first publicly traded company.

Adani always had been an opportunist and looking for the correct opportunity which he got in 1991 due to the coming of the era of liberalization. The policies of liberalization acted in favor of his business due to which he expanded into businesses like metals, textiles, and agro products.

The turning point in his life was when he got the contract of management of Mundra Port announced by the Gujarat government in 1995 which today made his company Adani Ports & SEZ, the largest private multi-port operator as well as Mundra port, India’s largest private sector port.

The journey of becoming the country’s largest thermal power producer started in 1996 with the founding of Adani Power which has plants pan India today for power generation.

Decades of Rise

Adani doesn’t enclose himself in small spaces, and always tries to take things to next level.

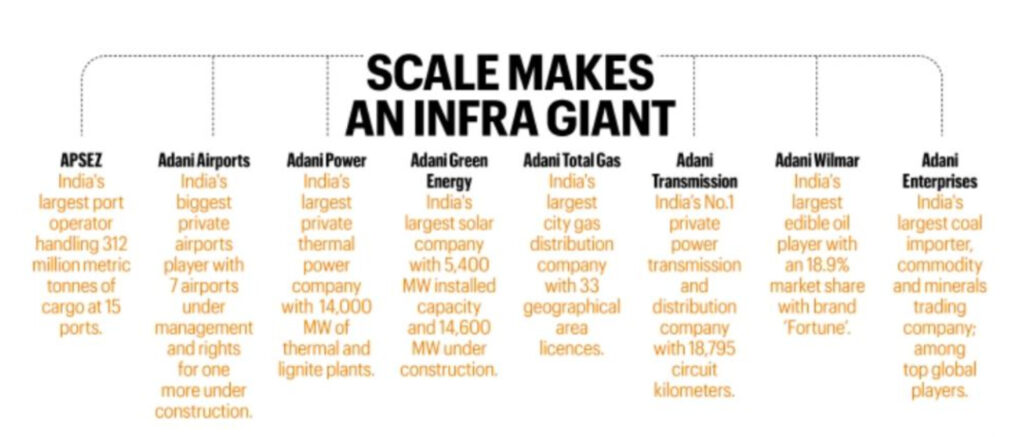

Starting with a commodity trading business in 1988, Adani Enterprises successfully listed itself in both the Bombay Stock Exchange and National Stock Exchange in 1994. It once owns diverse businesses including port operations, IRM, FMCG, Gas distribution, mines, and power but after several demergers now it owns a range of businesses from Defence and Aerospace to Agro and warehousing, also from aviation and IRM to green energy and data centers. In 2021, it won the bid of operating Mumbai airport and 5 other airports making it the biggest private player in airport management.

In 1999, the Adani group partnered with Singapore-based food processing giant Wilmar Internationals which resulted in the incorporation of Adani Wilmar. Incorporated in January 1999, on the plains of Sabarmati, Ahmedabad, Adani Wilmar Ltd. became the country’s largest edible oil producer with the most familiar edible oil brand in every Indian household “Fortune” and one of the largest FMCG companies in India.

In 2005, Adani incorporated “Adani Gas Ltd.” later known as Adani Total Gas as a joint venture with French oil and gas company Total Energies for providing PNG and CNG gas distribution facilities to both residential and industrial customers in India. It was demerged from Adani Enterprises in 2018. Today, it has a combined presence of 41 geographical areas in 74 districts in states like Odisha, Rajasthan, Tamil Nadu, Gujarat, and Haryana making it India’s largest city gas operator.

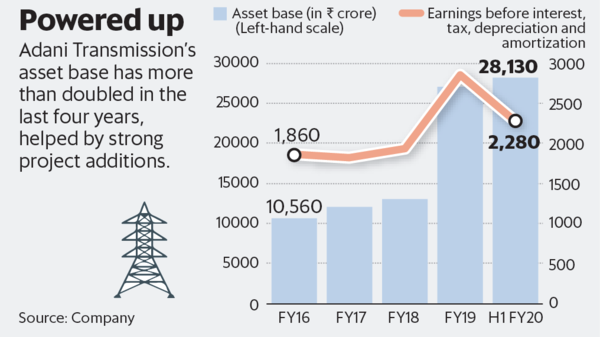

Currently, India’s one of the largest private sector transmission companies which at present operates a cumulative network of nearly 12200 circuit kilometers is owned by Adani under the name of Adani Transmission which was incorporated in 2013 in the business of operating and maintaining electric power transmission systems.

A record-breaking of handling 13 strategically located ports and terminals which represent nearly about 24% of the country’s port capacity shows how the Adani ports have always been focusing on scale, scope and speed making Adani Ports & SEZ, India’s largest integrated ports and logistics company which demergered in 2015. The Mundra Port which is India’s largest private commercial port hosts the world’s largest coal import terminal which is also trying to introduce technological advancements which will lead in enhancing the cargo handling capacity of the terminals. It owns and manages the Dhamra Port in Odisha which is a deep water, all-weather, multi user, a multi cargo port having a fully integrated conveyer system for import and export and a coastal circuit for handling nearly 4000 TPH of cargo daily.

The company which operates one of the world’s largest solar photovoltaic plant, The Kamuthi Solar Power Project , which is owned by the Indian conglomerate Adani Green Energy Limited which was incorporated in 2016 and fully demergered from Adani Enterprises in 2018. It has a market cap of 3,26,635 crore rupees in 2022. It has 46 operational projects in 11 states of India namely UP, Rajasthan, Karnataka and Tamil Nadu etc. In May 2020, AGEL won the world’s largest solar bid worth 6 billion dollars by Solar Energy Corporation Of India.

Allegation

Being such a great businessman and possessing such a stature, Adani still is not untouched by allegations and controversies. Some of the most infamous allegations which surrounds Adani are the following ➖

A controversy that became the centre of attention in Gujarat and across the country in 2006 was the Land Scam of Gujarat. The allegations were that during the period of 2006 to 2008, the government of Gujarat provided land to the Adani Group for setting up of Adani Ports & SEZs at a very cheap rate of Rs 1 – Rs 32 per square feet where as the land which was provided to TCS, Tata Motors, Maruti Suzuki, etc at a high price of nearly Rs 1100-1200 per square feet. Defending this allegation that was made on Adani Group, they claimed that it was not due to any support but they were given the land at a very low cost due to barren and wasteful nature of the land.

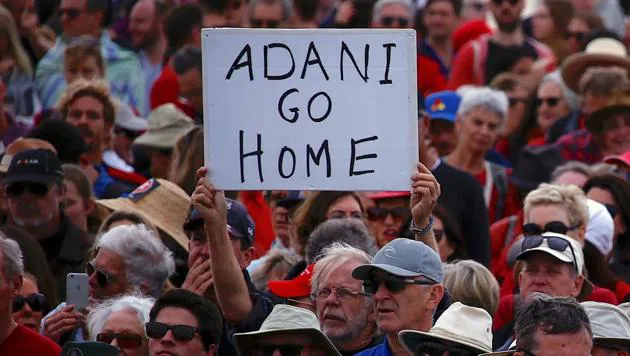

In 2010, Adani had acquired one of the world’s biggest coal mine “The Carmichael Coal Mine”, located inland from Great Barrier Reef in Queensland which has a capacity of producing nearly 60 million tonnes of coal annually for atleast 30 years. While he was going to start mining operations, he faced huge popular protests from the environmentalist and ecological activists of that region who argued that the mining would pose a great threat to the aquatic life, marine ecosystem as well as to the adjoining river beds. Adani faced several legal challenges as well as financial setbacks when financial institutions stepped back from providing an initial investment of nearly $16 Billion. The controversy further widened when allegations were put on Adani that he compromised with the laws and with the help and support of the government machinery, he tried and succeeded in starting mining operations on a minor scale which he is trying to expand to its maximum capacity.

The allegations that came up in the recent years on Adani was the transportation and detection of drugs in the Mundra Port of Gujarat.

There were several allegations put on The Adani Group but none of them have been able to hamper or obstruct the path of success and growth of Mr. Gautam Adani.

The Hindenburg Report

On 24 January 2023, a 106-page report created a sensation in the media and news where “ THE HINDENBURG” accused the world’s third richest man Mr. Gautam Adani as the world’s biggest “Corporate Con”. The Us short-seller firm asked nearly 88 questions to be answered by the Adani Group. Some of the most serious allegations that were made are how nearly 85% of the wealth of Mr. Adani was accumulated in the past 3 years, how the stocks are overvalued and has 85% downside on fundamental basis due to pleading of shares to raise loans ,how the shell companies are linked with the Adani Group which are allegedly controlled by Vinod Adani and through the shell companies Adani is acquiring the stock of its own enterprises whereas the maximum limit of a company after a IPO should be restricted to 75% as per SEBI. Another allegation that has been put on is that how the funds from the Adani group is channeled illegally to Mauritius through charity organisations. Some of the allegations are also related to the management as well as the decision making of the Adani group such as Adani group which consists of 22 directors in board, 8 of them are his own family members and it has a highly centralised decision making mechanism which is controlled by Mr. Adani himself. One of the most critical acusaition on The Adani Group has been that companies like Adani Enterprises and Adani Total Gas have been audited by a very unknown and small scale firm consisting of only 4 partners and 11 employees which everyone being novice to their job, the allegations are how can such a big business conglomerate assign a crucial task like auditing to such a firm.

Current Scenario

Adani group currently has a combined market cap of more than $250 Billion and became the third company to achieve this milestone in 2022 after Tata and Reliance Group. Presently, Adani group has seven listed companies in the stock market namely Adani Enterprises, Adani Ports &SEZ, Adani Transmission, Adani Total Gas, Adani Power, Adani Wilmar and Adani Green Energy.

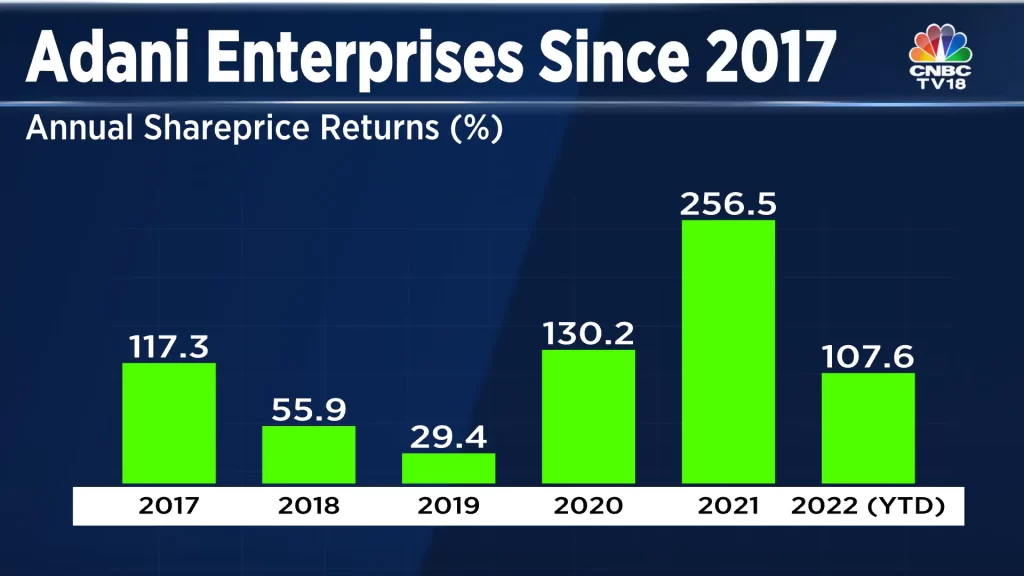

Gautam Adani had a net worth of $10 Billion in 2020 which he increased to $80 Billion in 2021. His net worth surges $72.5 Billion to $150 Billion in 2022 which is equal to the combined wealth added by 9 other billionaires.

Adani Group won the bid of redevelopment of world’s largest slum – Dharavi worth 5000 crores. He acquired a majority stake in NDTV thus entering in the media industry. Adani group had its largest merger till date of the merger of ACC cement with Ambuja Cement worth 50000 crores.

In the last week, The Adani Group has witnessed a crash in the stock prices for which they had to beer a loss of nearly 7.4 Lakh Crores in market capitalisation. The impact can also be also felt on the whole stock market due to such a drastic fall in the Adani Shares.

As a response to Hinderburg’s report, The Adani Group has issued a 413 page report where they have made several claims in defense of the company. The claims were that the Adan Group has executional excellence for which they showed how their net debt has reduced in the recent years. Also the group has questioned the legitimacy as well as the authenticity of the Hindenburg report on various claims. The company also clarified that they hired such a small auditing firm to uplift the firm.

Amidst the crisis, the Adani Group launched its FPO of Adani Enterprises on 27 January 2023 which was valued at 20000 crores and was also subscribed 1.12 times by investors at close. But as a big shock The Adani Group called off its FPO on 1 February 2023 even when it was fully subscribed and decided to payback the investors. The Swiss finance giant Credit Suisse has stopped accepting bonds from Adani Group of companies as collateral for margin loans which further intensifies the situation for Adani Group.

Future Prospects

Adani Group plans to invest $150 Billion out of which $50-70 Billion will be invested in green hydrogen business, $23 Billion in green energy, $7 Billion in electricity transmission, $12 Billion in transport utility and $5 Billion over the coming 5-10 years to achieve the dream valuation of $ 1 Trillion.

Adani group plans to build 3 Giga factories by the year 2030 as its initiative of green power investment.

The group has also planned to invest Rs 60000 crores in mineral exploration, energy and coal sectors.

Conclusion

While Gautam Adani has been crowned as world’s biggest gainer in the year 2022 by becoming India’s richest person. His life had been from many a roller coaster ride where he has seen both ups and down but the man has never gave up or looked back and always tried and gave his best to take his enterprise to an unprecedented level where it will not only create fortunes for his venture but also for the whole nation and the millions of youth on whom he has placed his bet. A person with clear vision and strategy as well as optimistic to create a legacy which will be remembered for generations makes Adani a person who can’t think small.

By Saket Goenka

Also Read:

PLAYING THE MARKET: STOCKS OR SLOTS-Deciphering the fine line

Playing the market: Stocks or Slots?Deciphering the Fine line The world of finance, the stock …

Social Echoes: Amplifying Sales through Digital Word-of-Mouth

Social Echoes: Amplifying Sales through Digital Word-of-Mouth It is a truth universally acknowledged that E-Commerce …

Unlocking the Potential: A Comprehensive Analysis of the IMEEEC

Unlocking the Potential: A Comprehensive Analysis of the India-Middle East-Europe Economic Corridor (IMEEEC) Abstract The …